Significant Cost Savings

& Quality Claims Reviews

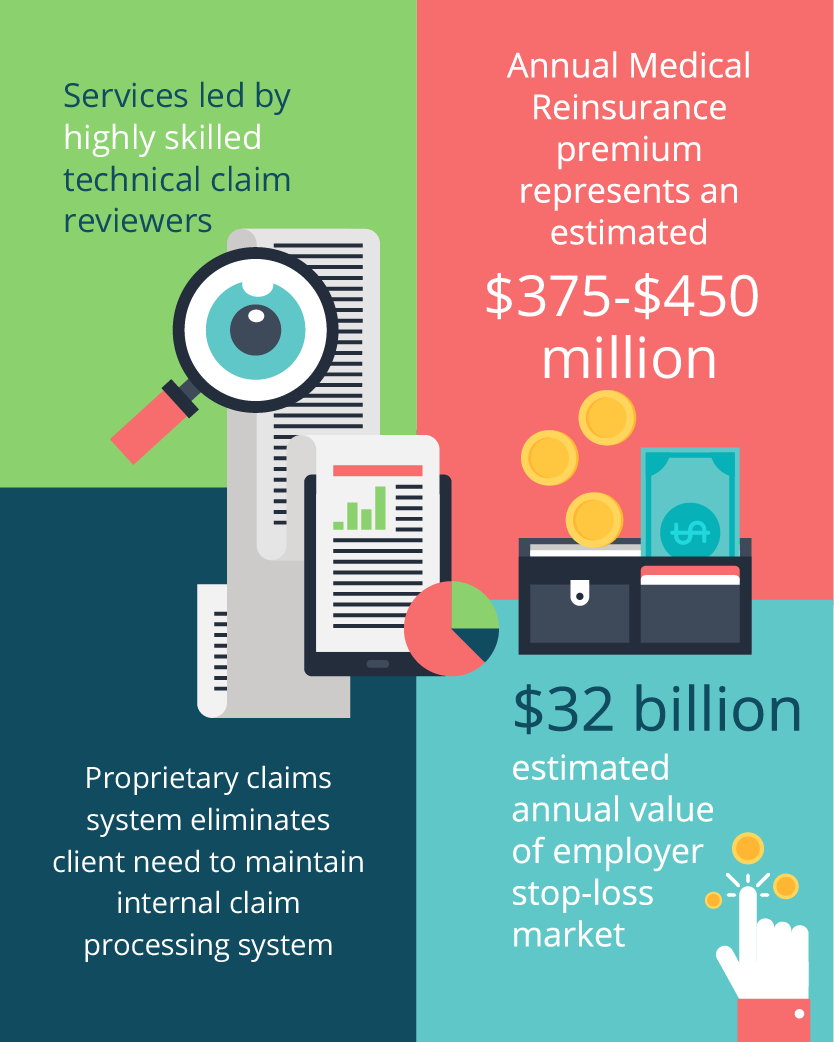

We deliver a range of specialty reinsurance claims management services to risk-bearing entities including insurance carriers, employer stop-loss coverage providers, MGUs, and hospital and physician organizations. Our highly skilled technical staff and proprietary claims system provide significant cost savings to our clients. Working with Davies allows our clients to spend more time on value-added activities for their expanding specialty product lines while our team alleviates the burden of investing in internal staff and claims processing platforms.

Davies monitors and evaluates the handling of self-funded employer stop-loss specific claims, establishes reserves, and reports to our clients and intermediaries. Our team of specialists recommends reimbursement and deliver claim backlog support by directly accessing our clients’ claim platforms or using Davies’ reporting tools.

How we help:

- Monitoring and evaluating the handling of self-funded employer stop-loss claims

- Establishing reserves

- Providing extensive reporting

- Recommending reimbursements

Claims Management and Auditing Solutions for Employer-Stop Loss and Managed Care

For over 30 years, Davies has invested in claims management and auditing for the employer-stop loss and managed care markets. Through a customized blend of people, processes, and technology, we help clients grow profitable operations, uncover cost savings, and safeguard key interests.

Employer Stop-Loss

We evaluate the handling of self-funded employer stop-loss specific claims, establishes reserves, and reports to our clients and intermediaries. We deliver reimbursement recommendations and also provide claim backlog support through your claims platform or our own reporting tools.

Managed Care

We analyze risk exposure found in data submissions, provide claim review recommendations and reporting, and draft policy language for the managed care market. Our clients also rely on us to resolve coverage issues and deliver recommendations regarding specific managed care risk-bearing providers, TPAs, HMOs, ACOs, and other health plans.

Repricing Services

Our proprietary claims system is one of our key differentiators for specialty reinsurance claims management. This system completely automates the fee schedule process and claims submission activity. Our team can quickly identify duplicates and streamline the data process for millions of transactions.