Give your customers the claims experience they deserve

Give your customers the claims experience they deserve

See some of our achievements below

The service you deliver is integral to the success of your business.

With the right technology, we can help you heighten your customer experience, improve underwriting performance, and streamline processes.

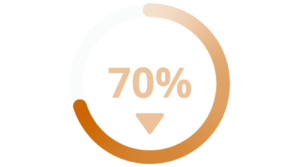

70% reduction in claim lifecycle using E-claim.

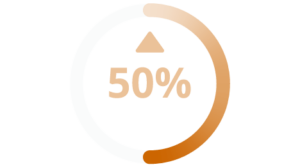

50% more fraudulent claims identified by those insurers using our technology – saving them $1.3m+ annually.

How we help

Driven by technology and powered by experience, Davies provides a suite of services to support you and your customers through the end-to-end claims journey. As the only provider with product validation provision, we work hard to deliver the best results possible, continuously investing in technology, automation, and team training for the ultimate customer experience.

What we do

Davies announces two senior promotions as it brings together its claims operations and retires Johns Eastern brand

Sarasota, Florida, US – February 19, 2024 – Davies, the leading specialist professional services and technology business serving insurance and highly regulated markets, has made two key senior promotions and has announced it will rebrand Johns Eastern, the specialist third-party administration (TPA) and independent adjusting firm, to Davies as it continues its rapid expansion of operations in North America.

Davies announces acquisition of leading international forensic accounting firm, MDD, adding new capabilities and new markets to its global business

LONDON, UK – 13 February 2024 – Davies, the leading specialist professional services and technology business serving insurance and highly regulated markets, today announced that it has signed a deal to acquire the leading international forensic accounting firm, Matson, Driscoll & Damico (“MDD”).

New policyholder portal launched in Ireland

Early in 2020 we launched our policyholder portal for a number of clients in Ireland. Little did we know the benefit it would bring, particularly during the COVID-19 lockdown period. This portal is the next step in our digital journey to transform the customer experience by providing self-service interaction. Online interaction was a real feature during the lockdown, and we could not have timed our launch any better.

Kuarterback – our latest investment in artificial intelligence

Kuarterback is our latest in a line of successful automated claims solutions, engineered using pioneering artificially intelligent technology. The system which can be deployed on any motor claim rapidly reads through a stage 2 pack received through the RTA portal, from medical reports to physio invoices, to convert content into structured data fields that can then be automatically processed against a set of agreed rules and valuation matrices to generate a claim value.

Drop us your email address and we will get in touch.